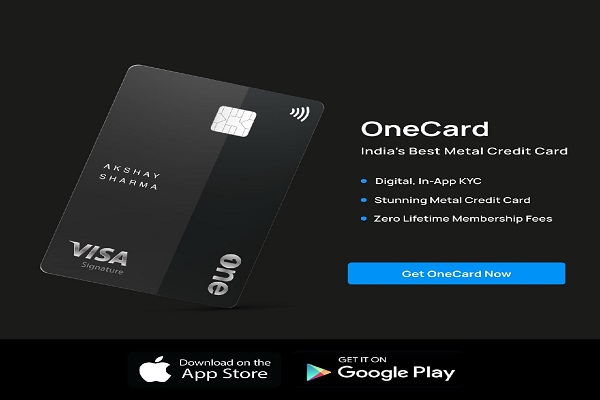

OneCard Review June 2022- The Best Free Metal Credit Card India? OneCard is a brand new form of credit score card that is fast gaining popularity because of its many advantages. For starters, OneCard gives 1% cashback on all purchases made with the cardboard. That manner that each time you use your OneCard, you’ll earn a little bit of cash again – which can add up over time!

In addition, OneCard has no annual prices, so you can use it as frequently as you like without having to worry approximately any hidden costs. Furthermore, OneCard expenses best 1% overseas markup on transactions made abroad. This is an high-quality gain for frequent vacationers, as it can save you loads of cash on global transactions.

OneCard is issued by means of FPL Technologies, a agency that is devoted to offering easy and obvious credit score products. FPL Technologies is dedicated to giving users returned control in their finances, and One Card is a first rate example of this commitment.

If you’re looking for a credit card that offers awesome advantages and is issued by a agency that you could believe, then look no further than OneCard!

ONeCard Fees and Charges

Annual Fee: One Card is a lifetime loose credit score card. Therefore, you do no longer pay an annual membership price for the card.

Interest Rate: If you fail to pay the amount due to your One Card announcement by using the price due date, you’re charged an hobby charge between 2.5% to three.5% in keeping with month (30% to 42% yearly) at the due amount.

The Forex market Mark-up: The foreign exchange mark-up rate applicable on transactions made in a foreign forex together with your One Card credit score card is 1% of the transaction quantity (lower than the same old 2.5%).

Cash Advance Charge: You are charged a coins enhance charge of two.5% of the withdrawn amount on cash withdrawals with your One Card Credit Card (concern to a minimal rate of Rs. Three hundred).

How to Apply for OneCard Credit Cards Online?

You can practice for the One Card Credit Card on line on the One Card website or through the One Card cellular app. All you want to do is input your cellular quantity and offer some primary information like ID evidence, PAN Card and proof of profits. In case your application is rejected due to a horrific credit rating or less income, you could also get One Card towards a set deposit with SBM Bank, that is certainly one of One Card’s banking partners.

Should You Apply for OneCard?

Unlike BNPL (Buy Now Pay Later) playing cards by way of Fintech startups like Slice and Uni Card, One Card is a complete-fledged credit card by means of FPL Technologies released in collaboration with its banking companions- IDFC FIRST Bank, Federal Bank, SBM Bank, BOB Financial and South Indian Bank. You need to bear in mind making use of for One Card if-

you want an access-stage metal credit card. One Card is perhaps the most effective entry-stage credit score card that comes in a metallic shape aspect.

You want the praise shape of One Card that lets in you to earn fractional Reward Points (as defined in advance).

You have a horrific credit score rating or no credit rating at all (due to lack of credit score records) and need a secured credit card with a decent praise charge. One Card is available as each secured (issued against a hard and fast deposit) in addition to an unsecured credit card.

You want an entry-degree credit score card with a lower overseas foreign money mark-up fee.

OneCard Credit Card Eligibility Criteria & Documentation

The eligibility standards that want to be fulfilled a good way to get a One Card Credit Card have no longer been defined actually by means of the cardboard company. However, the subsequent are a few basic eligibility requirements that you might need to fulfill:

The applicant’s age ought to be at the least 18 years.

The applicant must have a stable supply of earnings.

To get a secured One Card against a set deposit, no credit rating could be required. However, if you need to get an unsecured card. You would possibly need to have a decent credit score score (preferably above seven-hundred).

Documents Required

You might want the subsequent documents whilst making use of for a OneCard Credit Card:

An identification evidence (Aadhar Card, PAN Card, Voters’ Id, and so forth).

An address evidence (Aadhar Card, Passport, Utility bills, Driving License, and so on).

An profits proof in case of an unsecured card (contemporary bank statements/salary slips or present day ITR).

OneCard vs Pay Later Cards

One Card, as referred to earlier, is issued by means of the fintech startup FPL Technologies Pvt. Ltd. In collaboration with its banking companions just as pay-later playing cards like Slice Super Card and UNI Card. However, it’s miles basically one of a kind from. Those pay-later cards as One Card is an actual credit score card, even. As Slice Card and UNI Card are pay-later cards. That basically furnish you a private loan in opposition to a month-to-month line of credit.

Conclusion

Considering that it’s miles a life-time loose access-level credit card. One Card offers a respectable praise price among 0.2% and 1%. If you need to flaunt a metallic credit card however cannot come up with. The money for a fantastic-top class card. One Card can honestly be an excellent pick for you. Another high quality thing of One Card is that. It allows you to earn fractional Reward Points. Which means that even if a transaction isn’t always in multiples of 50. You continue to earn Reward Points in opposition to the complete quantity.

If you are eligible for an unsecured credit score card. Earlier than you are making up your mind. You must examine the functions and benefits of One Card. With the ones of mainstream entry-stage credit score cards like. Amazon Pay ICICI Bank Credit Card, Flipkart Axis Bank Credit Card and HDFC MoneyBack+ Credit Card.

Add a Comment